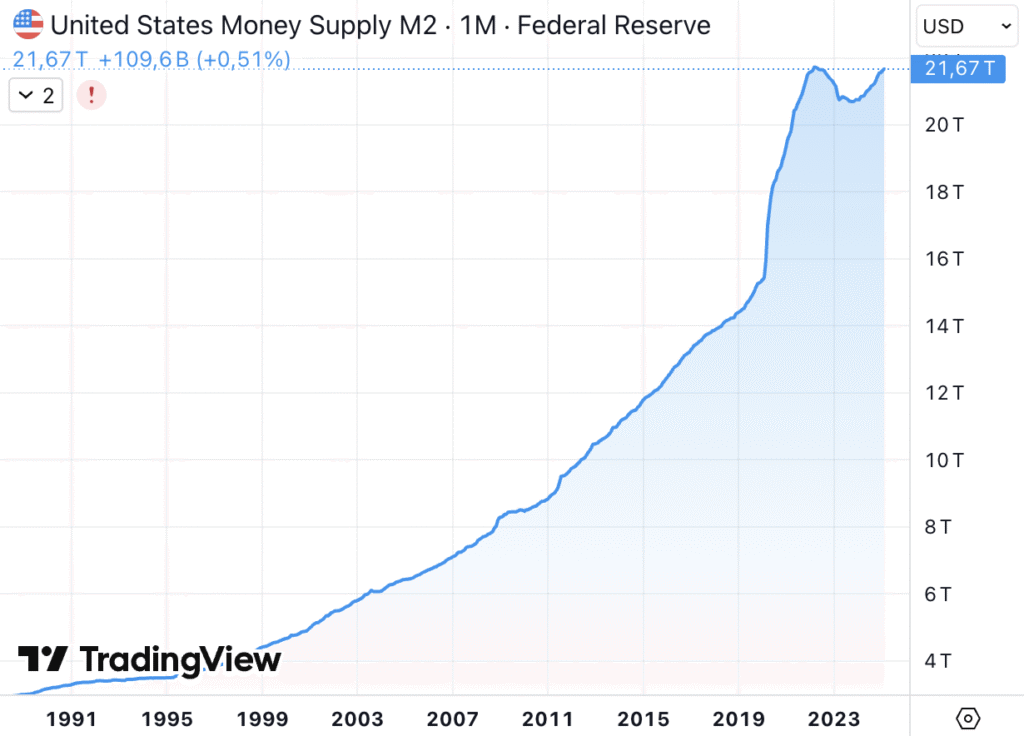

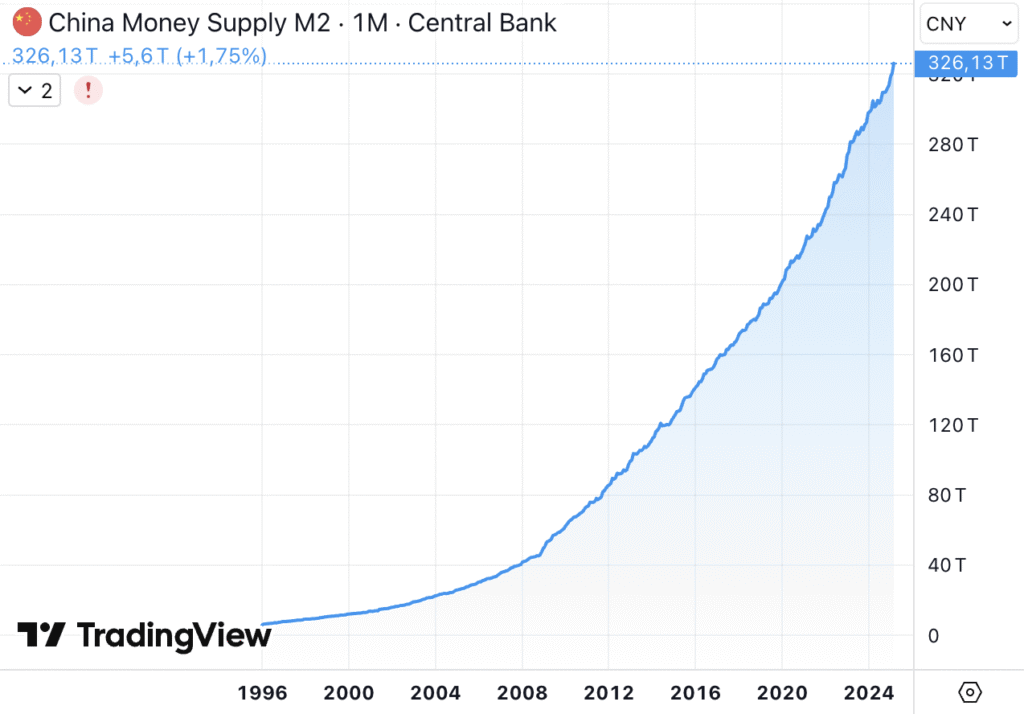

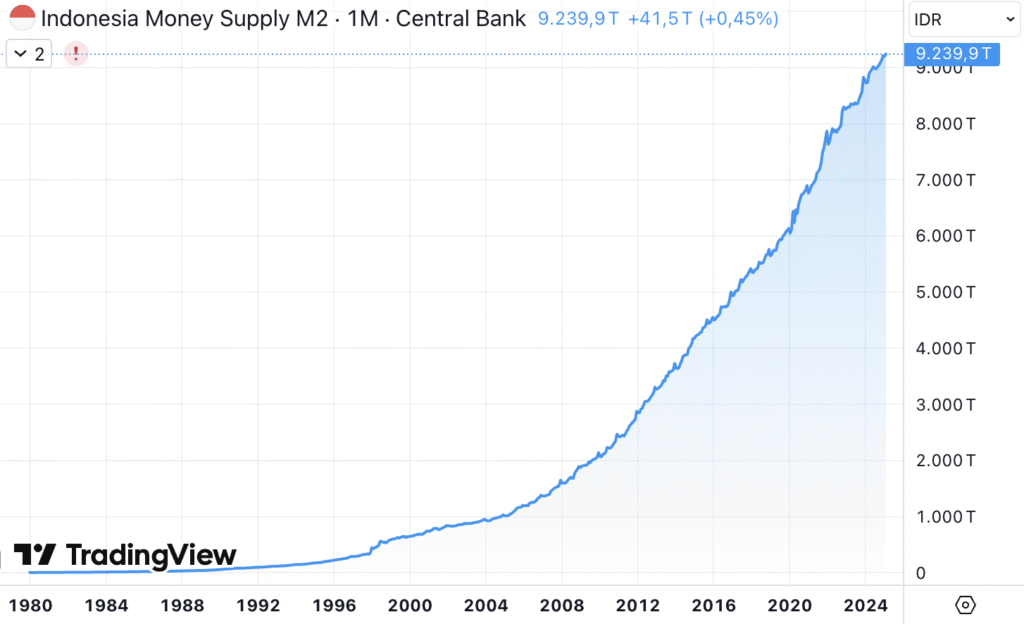

The flood is coming — few can see,

Staring blankly, drowned in apathy.

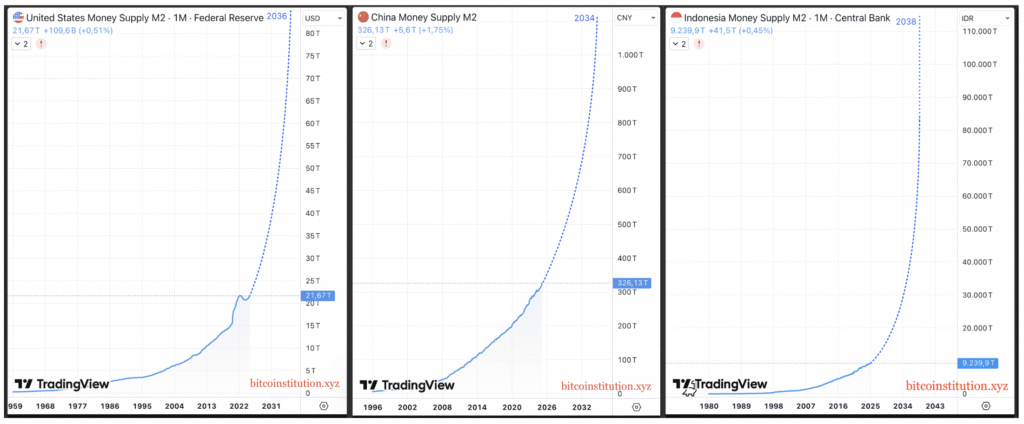

The waters rise — accelerating fast,The 2030s hit — and nothing lasts.

The ark is here — no gate, no guard,

A fixed-supply money, unstoppable, hard.

The ark’s door has opened, but not for late,

Your spot gets worse the more you wait.

Latecomers get corners, damp and cold —

If they get in at all, if truth be told.

Yes. That fixed-supply, unstoppable, hard money is bitcoin.

The more you delay your accumulation, the less bitcoin you’ll ever have.

Because if you zoom out far enough, bitcoin’s price consistently increases.

Why? That is what happens when humanity invents fixed-supply money while still using unlimited, exponentially inflating money. The smart people let go their unlimited broken money to accumulate the limited better money — the price increases.

Contents

Why gold is not the ark?

Gold on Earth is fixed-supply, unstoppable, and hard. Yet it’s no longer a good ark to save you from the fiat flood. Technological progress and globalization have made gold impractical as a medium of exchange.

If it were still practical, the 1944 Bretton Woods forum would’ve chosen gold as the world’s money. Instead, they made the USD act as both money and a gold certificate. And certificate — digital or physical — is corruptible.

Bitcoin doesn’t need a certificate. It’s a bearer asset. Global manufacturers can transact on bitcoin’s Layer 1 network, while everyday purchases happen instantly on Layer 2 network ( watch my demo on a bitcoin meetup here ).

Why other cryptocurrency couldn’t be the ark?

It’s a free competition, to be fair. Plenty of other crypto coins can process way more transactions per second than Bitcoin’s Layer 1.

But—

They all share a fundamental flaw: the need for a leader to promote them. Without a visible figure with a known identity, the project doesn’t take off.

Today, it’s impossible to create a better Bitcoin, beat its popularity, and still remain anonymous. Try it, if you dare. Good luck with that.

Why does the absence of a leader matter? Because to be the ark — to save humanity from the fiat flood — trustless assurance is non-negotiable.

Put a man behind a coin, and the assurance disappears.

Back in 1944, the USD was designed as limited money — its supply couldn’t exceed the gold reserves held by the U.S. But in 1971, the leader of that money (President Nixon, to be exact) chose to sever the gold backing for good.

You can’t trust humans. And even if you trust someone today, you can’t trust their future successors.

Bitcoin has no founder in control. No company. No central figure.

It has been that way since 2009; hence, it will remain so.

It’s a network of millions of computers running the exact same protocol, sharing the exact same database.

To change bitcoin’s monetary policy, you’d have to convince all of them to give up bitcoin’s most sacred values: its fixed supply and its proof-of-work energy requirement.

Good luck with that, too.

Why you should jump on the ark as soon as possible?

Because the later you buy a limited money like bitcoin, the more expensive it gets.

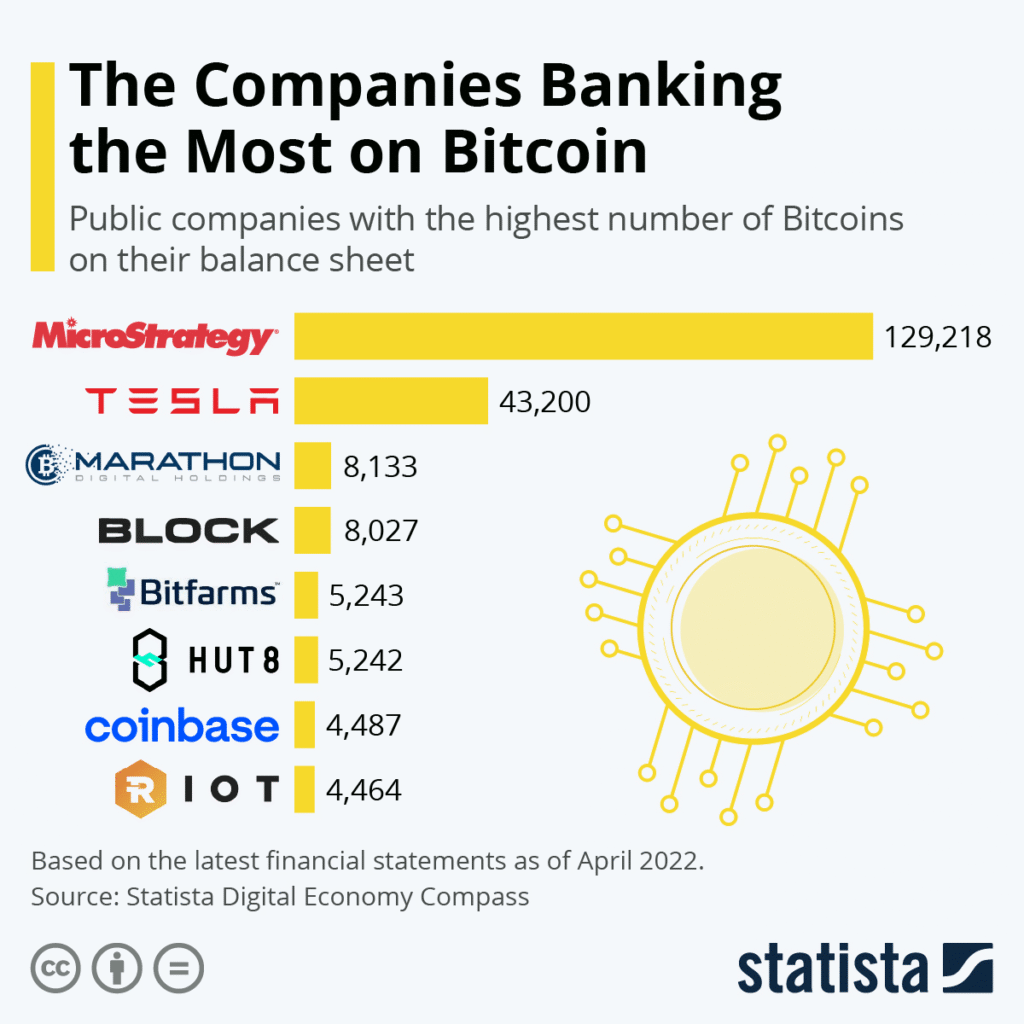

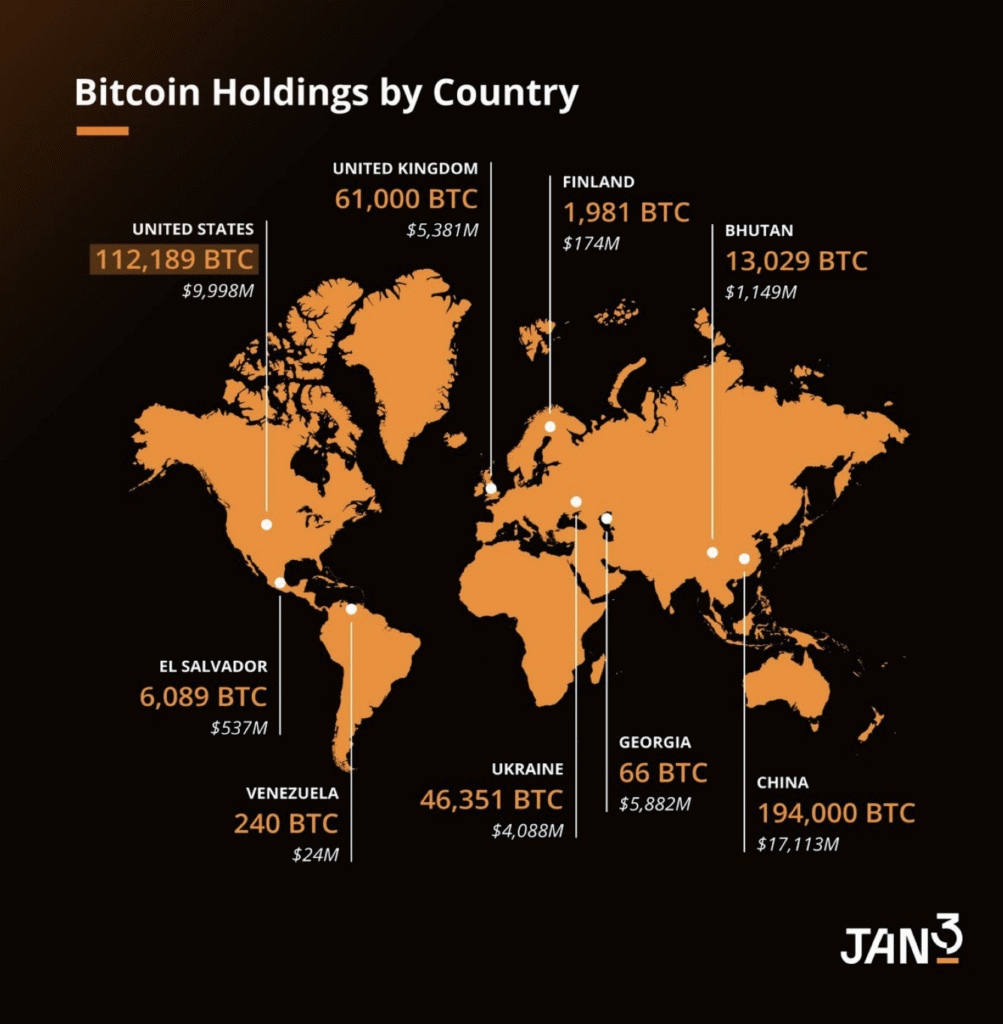

It’s no longer a race between individuals, visionary institutions already have skin in the game.

Buy it — and hold it with at least a four-year time horizon.

Wait — actually, don’t.

Don’t do it if you still have questions about The Fiat Flood or The Bitcoin Ark.

Learn first. If needed, contact a trusted Bitcoin Treasurer nearby. Especially if you want to accumulate bitcoin as an institution.

Never buy something you don’t understand.

Don’t fall for the hype.